Provided by Cigna

Dental Coverage

Manage Your Dental Benefits

Visit my.cigna.com or Download the Cigna app to:

- Access Digital ID Cards

- View benefits and claims

- Search for in-network providers

- Request costs of care estimates

- Update your Network General Dentist (DHMO only)

How to find your plan or switch plans: Your plan is listed on your dental ID card (digital cards are available at myCigna.com) and the THT member portal. You can switch your plan during the annual open enrollment period (typically in August) or any time during the year after experiencing a Qualifying Life Event (requests must be submitted within 31 days of the Qualifying Life Event).

Plan Comparison (In-Network Providers)

| Dental HMO* | Dental PPO* | |

|---|---|---|

| Deductible Individual/Family |

$0 / $0 | $0 / $0 |

| Maximum THT Pays Per person, per plan year |

Unlimited | $1,500 |

| Preventive Care | ||

| Oral exams | THT pays 100% | THT pays 100% |

| Cleanings (2 per year) | THT pays 100% | THT pays 100% |

| Routine X-Rays | THT pays 100% | THT pays 100% |

| Basic Services | ||

| Periodontal Services | THT Pays 100% | THT Pays 80% |

| Endodontic Services (Molar / Other) | THT Pays 60% / THT Pays 100% | THT Pays 80% |

| Oral Surgery | THT Pays 60% | THT Pays 80% |

| Fillings | THT Pays 100% | THT Pays 80% |

| Major Services | ||

| Bridges | THT Pays 60% | THT Pays 60% |

| Crowns (Inlays & Onlays) | THT Pays 60% | THT Pays 60% |

| Dentures (Full or Partial) | THT Pays 60% | THT Pays 60% |

| TMJ Appliance | THT Pays 60%, limit 1 per 24 months, no lifetime maximum benefit | THT Pays 60% up to $500 lifetime maximum |

| Orthodontia Services | THT pays 60%, no maximum or age limit | THT pays 100% up to $1,000 lifetime maximum, age 18 and under only |

| Sealants | No age limit | Age 18 and under only (1 treatment per tooth per 24 months) |

| Teeth Whitening Home Kits | $165 per arch, 2 per year | No benefit |

| Access to Pediatric & Orthodonists? | Yes | Yes |

| Emergency Care Covered? | Yes | Yes |

| Out of Network Coverage? | No | Yes |

| Referrals Required for Specialists? | Yes | No |

| Must Select a General Dentist? | Yes | No |

*The comparison above is only a summary and does not account for all possible procedures and billing codes. Any discrepancies between the benefits listed above and the plan documents will be resolved in favor of the plan documents. Full DHMO benefit details are available in the Patient Charge Schedule (PCS). For more information on the DHMO or DPPO, visit my.cigna.com or call Cigna at (800) 564-7642. If seeking treatment that is expected to be $200 out of pocket or more, THT recommends getting a formal estimate from your provider/Cigna.

DPPO

Our Dental PPO plan offers the freedom to choose any licensed dentist for your dental care needs. This network provides access to high-quality dentists across the country. However, if you choose an in-network dentist that is part of your Cigna Healthcare SM DPPO network, you can save money on covered dental services.

Annual Benefit Maximum

Members on the DPPO have an annual limit of $1,500 (per family member). If you exceed this limit, you will be responsible for the cost of services, even if they would normally be covered by THT.

Benefits Summary

| In-Network | Out-of-Network* | ||

|---|---|---|---|

| Plan Year Maximum (per person) | $1,500 | ||

| Preventive Care Oral exams, cleaning (2 per year), x-rays |

THT pays 100% | THT pays 80% | |

| Basic Services Periodontal services, endodontic services (root canal), oral surgery, fillings |

THT pays 80% | THT pays 50% | |

| Major Services Bridges, Crowns (inlays & onlays), dentures (full or partial) |

THT pays 60% | THT pays 50% | |

| TMJ Appliance Lifetime Maximum Benefit | $500 | ||

| Orthodontia Services (under age 19 only) | THT pays 100% | ||

| Orthodontia Lifetime Maximum Benefit | $1,000 | ||

If seeking treatment that is expected to be $200 out of pocket or more, THT recommends getting a formal estimate from your provider/Cigna.

*If you choose to see an out-of-network dentist, you will incur additional out-of-pocket expenses, and you will be billed the total amount the dentist charges (called balance billing).

- 2026 Standard Summary Plan Description (SPD)

- 2026 SPD for Arkansas Residents

- 2026 SPD for Louisiana Residents

- 2026 SPD for Mississippi Residents

- 2026 SPD for Texas Residents

Additional Riders: (for residents of AZ, AK, CA, CO, FL, IN, LA, MD, MA, MO, NY, ND, UT, & WA)

Travelling or Reside Outside of Clark County?

This network provides access to high-quality dentists across the country. Simply verify with Cigna and the dentist that they are in-network to receive your benefits and lower your costs.

Did you know?

Over half of the providers on the Dental PPO network are also on the Dental HMO network. You may be able to change to the HMO plan (which offers more benefits at a lower premium) and keep your provider.

DHMO

Our Dental HMO plan offers unlimited benefits and allows for orthodontia benefits at any age. This is the largest dental HMO network in Clark County, and each member on the plan can have a dentist of their choosing. You MUST select a Network General Dentist (NGD), i.e. primary dental provider, before scheduling services.

Annual Benefit Maximum

There is no annual benefit maximum or deductible for members on the DHMO plan.

Benefits Summary

Refer to the Patient Charge Schedule (PCS) for a detailed list of covered services and the cost for each. For a list of cost estimates before you enroll, call Cigna at 800-564-7642. After you enroll, a PCS will be mailed to your home. You may also obtain the PCS by visiting my.cigna.com or calling 800-244-6224. If seeking treatment that is expected to be $200 out of pocket or more, THT recommends getting a formal estimate from your provider/Cigna.

Additional Riders: (for residents of AZ, AK, CA, CO, FL, IN, LA, MD, MA, MO, NY, ND, UT, & WA)

Selecting a Network General Dentist (NGD)

You can change your Network General Dentist (NGD) at any time during the plan year by contacting Cigna below. However, you must make any changes before the 15th day of the month to take effect on the first day of the following month.

Reside Outside of Clark County?

The DHMO network is not offered in the following states/territories: Alaska, Idaho, Maine, Montana, New Hampshire, New Mexico, North Dakota, Puerto Rico, South Dakota, Vermont, Virgin Islands, West Virginia, and Wyoming. If you or your dependent(s) reside in one of these states, it is recommended you consider the DPPO. As a member with DHMO in these states, you or your dependent would have to travel to a different state to receive dental benefits.

Travelling?

Call Cigna for assistance with care and information about restrictions. Unexpected but necessary dental services are covered when performed by any licensed dentist under emergent circumstances. There is no out-of-the-country coverage on the DHMO plan.

Virtual Dental Care

Dentist Consultation

Toothaches, chipped teeth and oral infections don’t care what time of day it is. But neither do the Cigna virtual dentists. If you need dental care and are unable to reach your regular provider, you now have the option to consult with a dentist through a video call. The best part? Cigna virtual dental care is available 24 hours a day, seven days a week, 365 days a year!

This service connects you with a licensed dentist who, through a video call, can help address urgent dental situations like toothaches, infection, swelling, bleeding, and more. They can also prescribe medication to be filled at your local pharmacy, if necessary. If in-person care is necessary for your dental issue, they will help refer you to a local in-network dentist. They will also share any records from your virtual visit with your local provider.

Costs for Virtual Consults

Though there is typically no copay or coinsurance for virtual consults, they do count towards your service frequency limit (e.g. 2 exams per year) and the annual benefit maximum (DPPO has a maximum, DHMO does not).

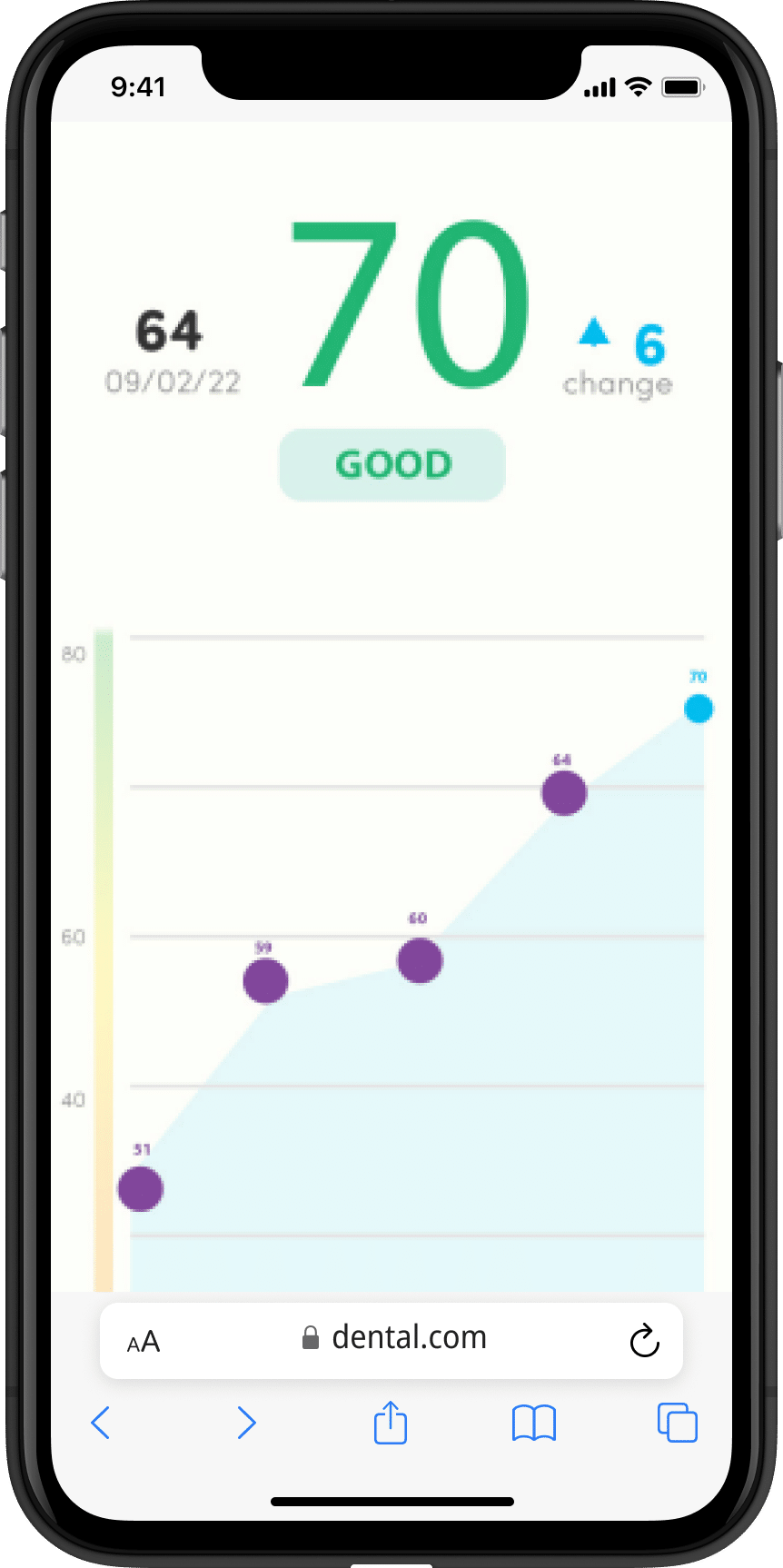

SmartScan - AI Dental Review

SmartScan provides a fast, free and painless way to stay on top of your oral health. SmartScan is not a replacement for a full exam and x-rays done in a dental office, which are important ways to protect your teeth, gums and overall good health.

If your oral rating is green, you’ll have peace of mind knowing your mouth is healthy. If your oral rating is yellow or red, you can cannot with or virtual dentist right away or be referred to an in-network provider.

What does SmartScan look like?

• SmartScreen screenings are available at no additional cost for all THT members (DHMO and DPPO)

• The process takes approximately five minutes from start to finish

• You’ll get an understanding of your oral health status plus health tips on how to improve your oral health

Dental Emergency

If you have a dental emergency, call your dental office immediately. Most dental offices have an after-hour emergency number if you call outside of business hours.

When you experience dental pain, it’s important to know if you need emergency dental care and if your dental insurance plan covers you. Not all dental problems are emergencies. A tooth falling out, a toothache, a chipped tooth, or pain from a dental crown could be serious dental problems, but not necessarily emergencies, so it’s best to consider your options in advance.

Covered Emergency Services:

- Immediate dental treatment to control excessive bleeding, relieve severe pain, or eliminate acute infection,

- Swelling in the mouth area that is the result of infection or abscess,

- A loss of filling or crown causing acute pain.

For covered emergency services, you are responsible for the copays/coinsurance that are listed on your Patient Charge Schedule (for DHMO members only, available in the MyCigna portal). After your appointment, you can request payment from Cigna. You are allowed to ask for the difference between the fee and your normal copay/coinsurance up to a total of $50 per incident. However, this amount may vary by state. To make a request, you need to send the dentist’s itemized bill to Cigna Dental.

If you are away from home and cannot contact your dentist, you may receive emergency care from any licensed dentist. However, this applies to unexpected but necessary services only. Emergency services are limited to relieving severe pain, controlling excessive bleeding, and eliminating serious and sudden (acute) infections. If you need routine restorative procedures or definitive treatment (root canal), you should return to your NGD for these procedures.

If you receive emergency care after regularly scheduled hours, see your Patient Charge Schedule for the copay/coinsurance for emergency care. This cost will be in addition to copays/coinsurance that may apply. If you need further assistance, you can contact customer service at (800)-244-6224.